Table of Contents

- New Roth 401(k) Rule Changes: What You Should Know for 2025 | Kiplinger

- How Much Should I Contribute to My 401(k)?

- The Champions of the 401(k) Lament the Revolution They Started - WSJ

- 401(K) contribution limits are set to rise in 2024 - here's how to plan ...

- Changes to 401(k) Contribution Limits for 2020 | ConnectPay

- Max 401k Employer Contribution 2025 - Lillian Wallace

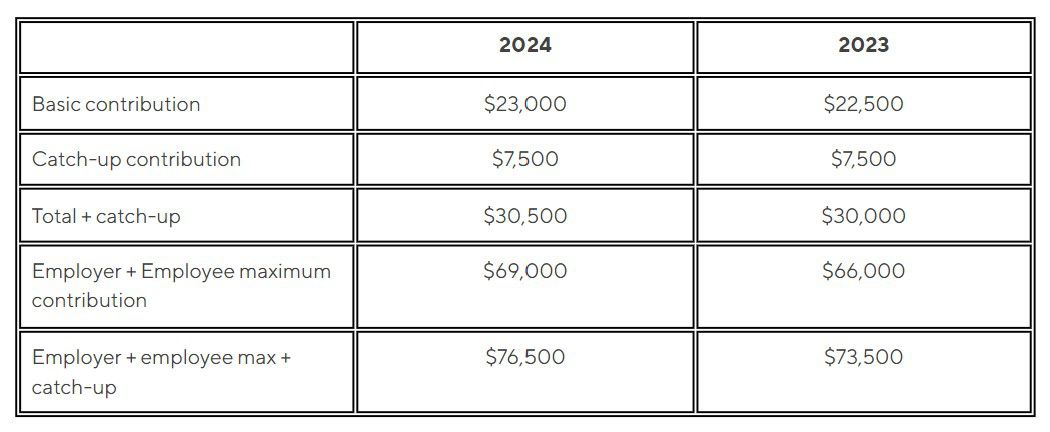

- 401k Contribution Limits for 2024: Everything You Need to Know - Intuit ...

- Accounting for Employee after-tax 401k contribution (This is NOT ...

- MASSIVE 401k RULE CHANGE COMING | Mandatory 50+ Catch Up Contributions ...

- How Much Contribute … - Adelle Crystal

What are 401(k) Catch-Up Contributions?

2025 Updates

2026 Updates

Looking ahead to 2026, the IRS has announced the following updates: The standard annual contribution limit for 401(k) plans will increase to $23,000. The catch-up contribution limit for individuals 50 and older will increase to $8,000. The overall limit for defined contribution plans will increase to $67,500. These updates will provide even more opportunities for older workers to boost their retirement savings. With the increased catch-up contribution limit, you can contribute an additional $8,000 to your 401(k) plan, bringing your total annual contribution to $31,000.